how to calculate tax on uber income

UBER OLA Taxify GST and TAX calculatorThe aim of this calculator is to provide tax estimation based on your driving date and quarterly income. For example if your taxable income after deductions is 35000 you will.

Uber Tax Information Essential Tax Forms Documents

What the tax impact calculator is going to do is follow these six steps.

. If your annual income is over 18000 and less 37000 then the tax rate is 19 and you can get 675 1-19 54675. Youll report income through the standard tax return Form 1040. We are temporary facing.

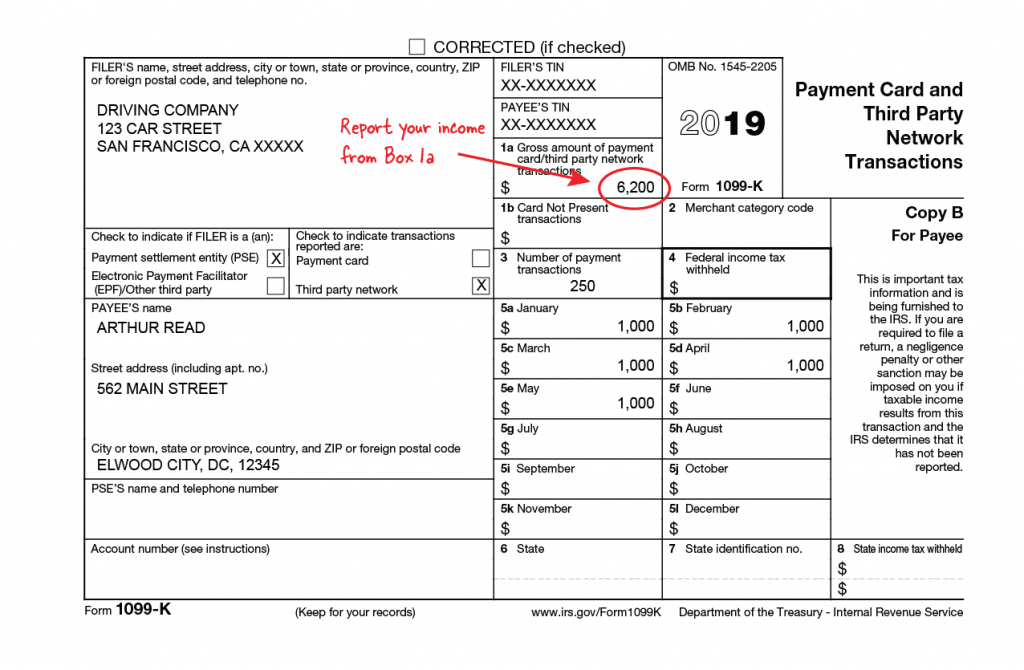

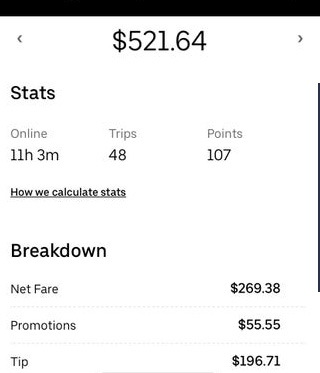

This form shows the total amount your passengers paid for rides. The above rates include the Medicare Levy Each time you get paid from driving put that percentage aside. Im not a tax expert or a professional CPA.

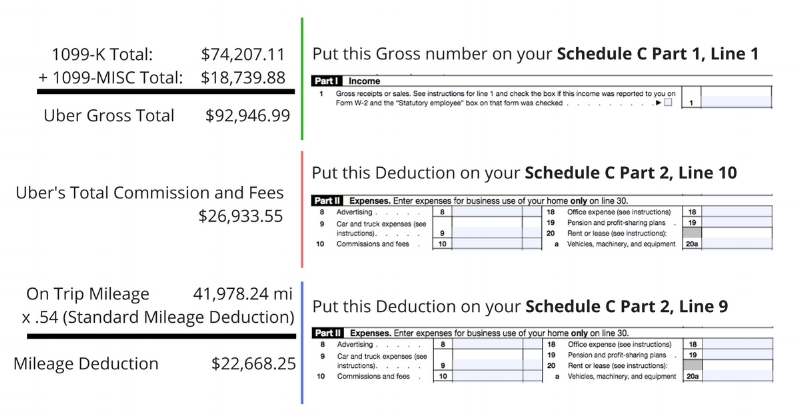

This includes all money you get from passengers including the Uber commission and the other fees. If your annual income is over 37000 then the tax rate. You start out by adding up your.

You should file a Form 1040 and attach Schedule C and. If youre an Uber driver youll need to declare the income youve generated in the financial year on your tax return. 100 percent of the tax you paid the previous year or 110 percent if youre a high-income taxpayer.

For the majority of you the answer is yes If your net earnings from Uber exceed 400 you must report that income. Youll use Schedule C to list your income and expenses and expenses write-offs. Your tax savings will grow and at the end of each.

Heres an important warning. This is just a simple calculator to see an estimate of your taxes with standard deductions. This is only calculating income tax on your business profits not the entire income tax bill.

Dont spend all of your Uber income. Thats because were focusing only on the tax impact of your Uber Eats and other. 90 percent of your total tax due for the current year.

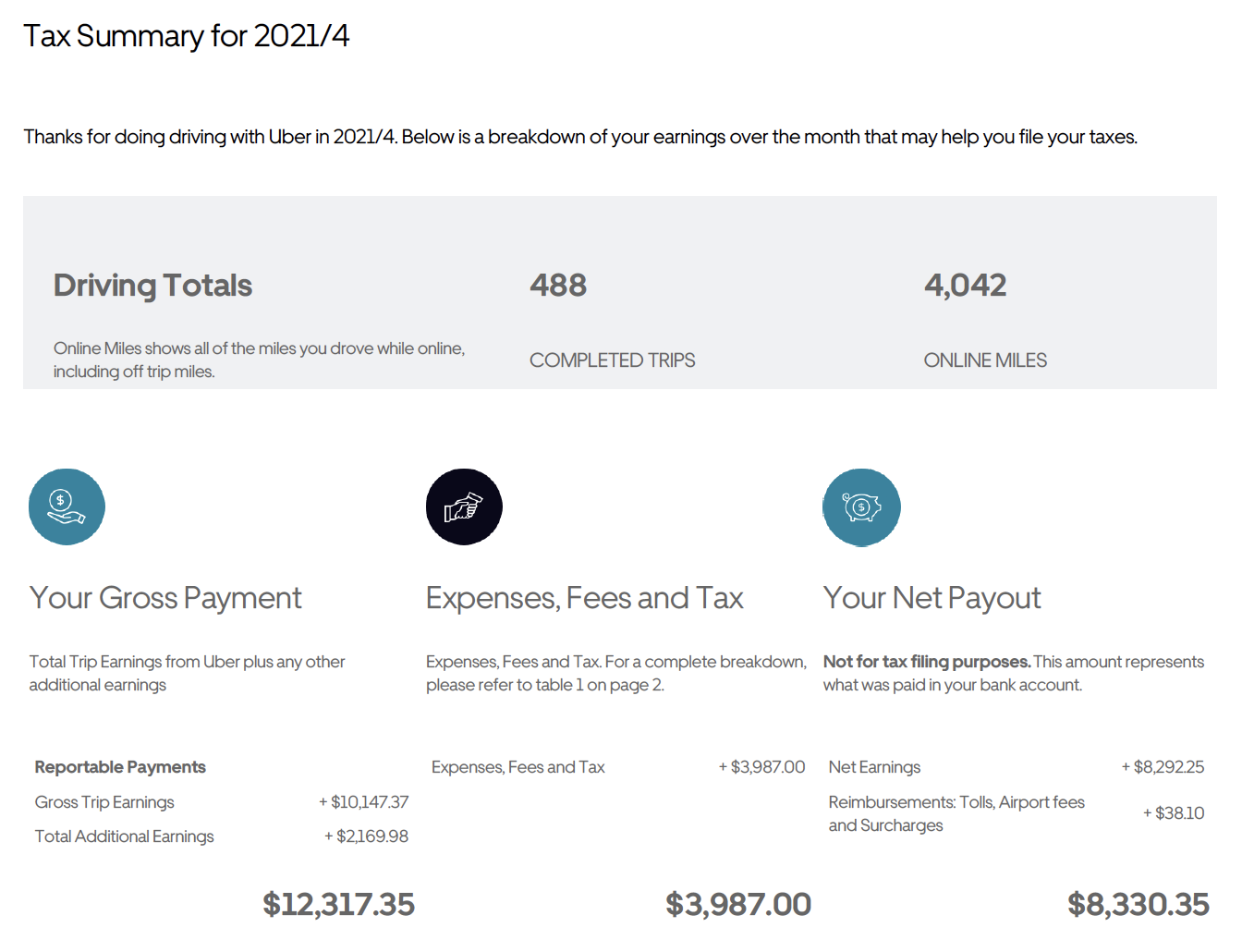

The tax summary provides a.

Form 1099 Nec For Nonemployee Compensation H R Block

Tax Tips For Rideshare Drivers Tax Guide For Lyft Uber Drivers

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

The Uber Lyft Driver S Guide To Taxes Bench Accounting

Uber Tax Information Essential Tax Forms Documents

Uber Tax Forms What You Need To File Shared Economy Tax

Highest And Lowest Uber Eats Driver Pay From 880 Week To 1 50 Orders Ridesharing Driver

The Uber Lyft Driver S Ultimate Guide To Taxes Ageras

Uber Tax Explained The Ultimate Guide To Tax For Uber Rideshare

Uber Tax Explained The Ultimate Guide To Tax For Uber Rideshare

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Uber Tax Information Essential Tax Forms Documents

How To File Your Taxes For Uber Lyft And Other Popular Gig Apps

How Much Do Uber Drivers Make Pay Salary Review

Uber Drivers How To Calculate Your Taxes Using Turbotax

How To Make Over A Hundred Bucks An Hour With Uber

Tax Tips For Uber Lyft And Other Car Sharing Drivers Turbotax Tax Tips Videos

(Distance)%20%2B%20Base%20Fare%20%2B%20Booking%20Fee%20=%20Fare%20per%20Ride.png?width=468&name=(Time)(Distance)%20%2B%20Base%20Fare%20%2B%20Booking%20Fee%20=%20Fare%20per%20Ride.png)